broward county business tax receipt search

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report. Records Taxes and Treasury DivisionTaxes And FeesTourist Development Tax About Contact Agency Agency Pic Agency.

NIGP Code of Ethics Vendors Must Comply with All State and Local Business Requirements All vendors located within Broward County must have a current Broward County Local Business Tax Receipt formerly known as an Occupational License Tax unless it is exempt.

. The total value of economic activity related to Port Everglades is nearly 30 billion. Delinquent Tangible Personal Property bills are charged a 15 interest per month and advertising costs. Credit and debit card payments are charged 255 of the total amount charged 195 minimum charge.

A Business Tax Receipt will be issued if the business meets the City requirements. 1 2015 unpaid Business Tax Receipts for the 2015-16 year become delinquent and are subject to additional penalties and fees. No local taxes were used for the Slip 2 extension project.

Enter a name or address or account number etc. The Local Business Tax formerly known as Occupational License is required of any individual or entity any business or profession in Broward County unless specifically exempted. The vendor must have a Broward Business Tax Receipt and be located in and doing business in Broward County.

Broward County Florida government that does not rely on local tax dollars for operations. The Division part of the Finance and Administrative Services Department collects residential and commercial property taxes local business taxes tourist development taxes and other taxes on behalf of various authorities. A Local Business Tax Receipt is required for each location you operate your business from and one for each category of business you conduct.

County Offers Convenient Way to Pay Property Taxes - Express drop-off service for tax payments November 27th - BROWARD. Search all services we offer. Renew Vehicle Registration.

Search and Pay Business Tax. Records Taxes and Treasury DivisionTaxes And FeesTourist Development Tax About Contact Agency Agency Pic Agency. Delinquent Real Estate bills are charged a 3 interest and advertising costs.

Search and Pay Property Tax. Taxpayers registering for Tourist Development Tax may be required to obtain a Broward County Local Business Tax Receipt. Broward County Records Taxes and Treasury Division 115 S.

The duties and authority of the County Recorder are established by state law. All unpaid Business Tax Receipts become delinquent October 1 and are assessed a penalty. Search and Pay Business Tax.

For additional information and assistance please call 954-357-6200. Taxpayers registering for Tourist Development Tax may be required to obtain a Broward County Local Business Tax Receipt. For more information on the Records Taxes and Treasury Division visit our website.

Property taxes local business taxes tourist development taxes and other taxes on behalf of various authorities. Property taxes for 2021 are due and must be paid no later than March 31 2022 to avoid delinquency interest fees and penalties. When you pay a Local Business Tax you receive a.

Pay Tourist Tax. The City issues restricted business tax receipts to work out of the home. Loading Search Enter a.

You will also be required to include a copy of your Florida drivers license or state-issued identification and to complete the Home Office Affidavit to submit with your application. As the Countys tax collector provides treasury services and is the statutory repository for the Official Records of the County. 2021 Property Tax Bill Brochure PDF 220 KB 2021 Taxing Authorities Phone List PDF 72 KB Frequently Asked.

Each owner must not have a personal net worth exceeding 1320000. The Local Business Tax formerly known as Occupational License is required of any individual or entity any business or profession in Broward County unless specifically exempted. The annual renewal period is July 1 through September 30.

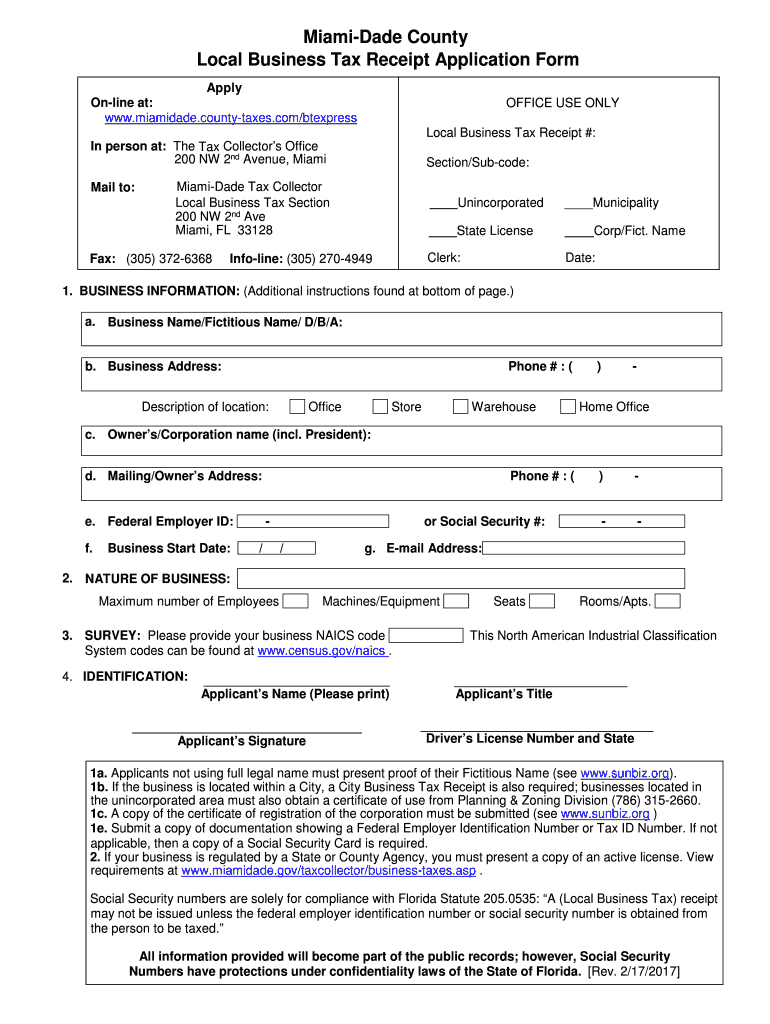

Local Business Tax Receipt Application Form PDF 135 KB Broward County - Fictitious Name Form PDF 223 KB List of Local Business Tax Receipt Categories PDF 72 KB Local Business Tax Receipt Exemption Application Form PDF 149 KB Property Taxes. If an Echeck payment is submitted with the incorrect account information or returned unpaid for any reason a fee of up to 5 may be charged per Florida Statute 1250105. If you do not receive your renewal notice you should contact the Broward County Call Center at.

A Local Business Tax Receipt is required for each location you operate your business from and one for each category of business you conduct. Your bill will be stamped and returned to you as proof of your payment receiptOnly full payment of the November amount. Duties and Authority of the County Recorders Office.

Pay Tourist Tax. About Broward Countys Records Taxes and Treasury Division.

Business Tax Receipt How To Obtain One In 2022 The Blueprint

Free 5 Sample Business Tax Receipts In Ms Word Pdf

Forming Business In Broward What You Ll Need To Do Llc Or Fictitious Name Sunbiz Org Ein If You Ll Be Selling Ta Business Tax Broward Buying Wholesale

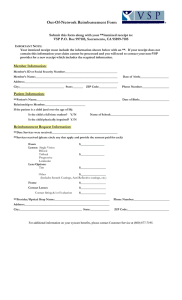

Free 5 Sample Business Tax Receipts In Ms Word Pdf

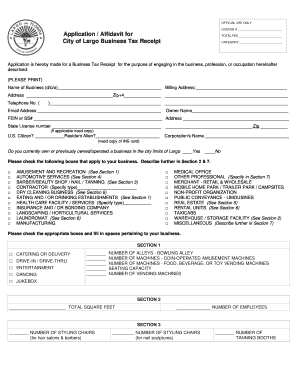

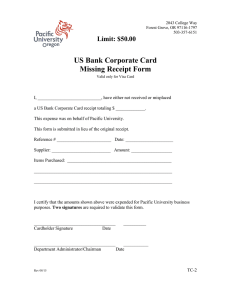

Get And Sign Largo Local Business Tax Polk County Form

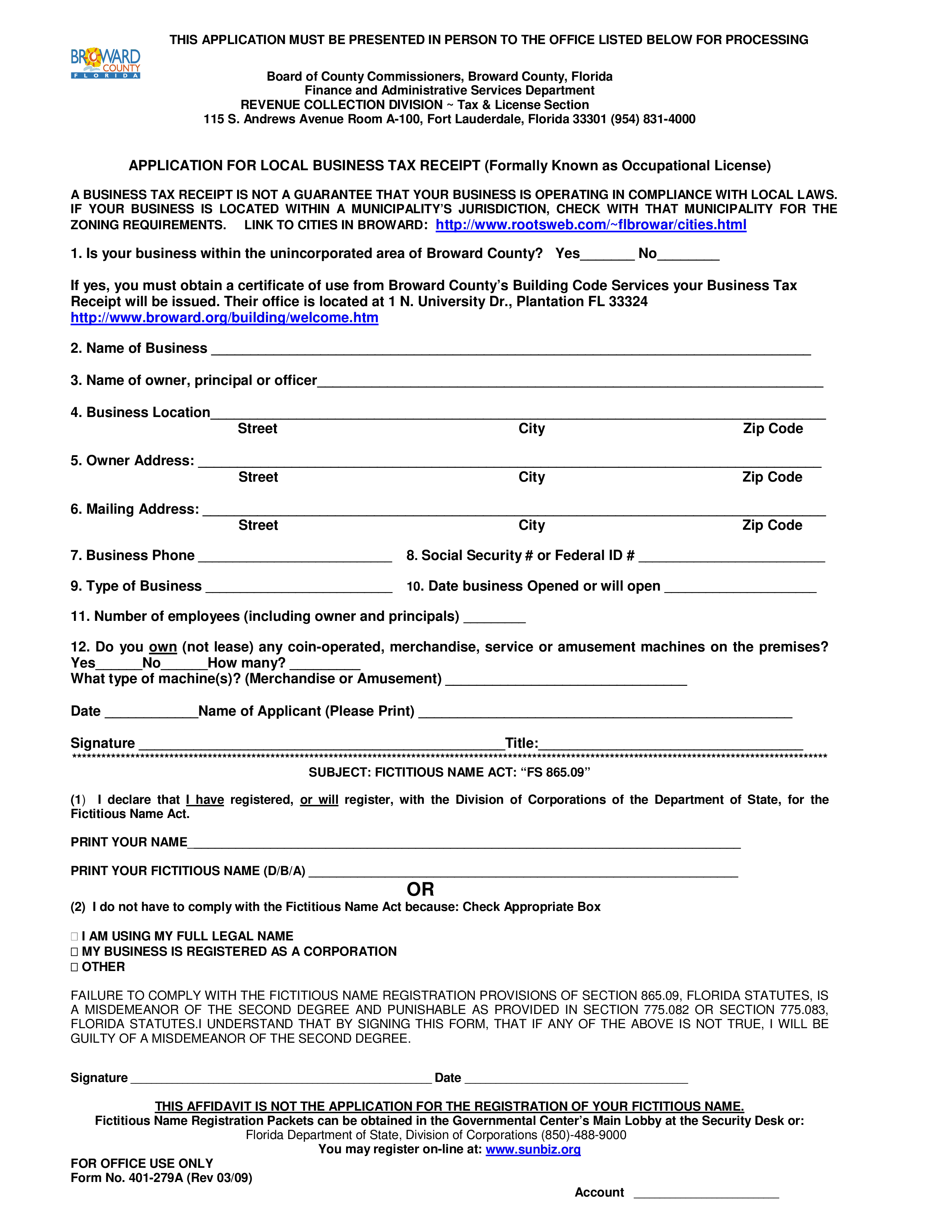

Application For Local Business Tax Receipt Templates At Allbusinesstemplates Com

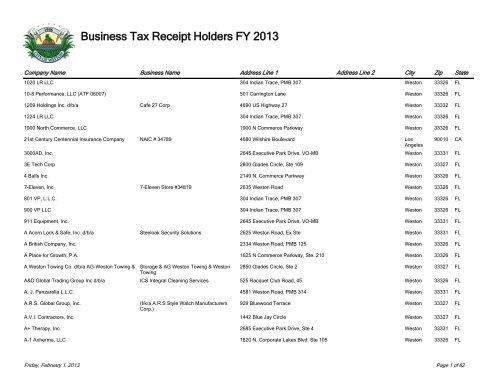

Business Tax Receipt Holders Fy 2013 City Of Weston

Free 5 Sample Business Tax Receipts In Ms Word Pdf

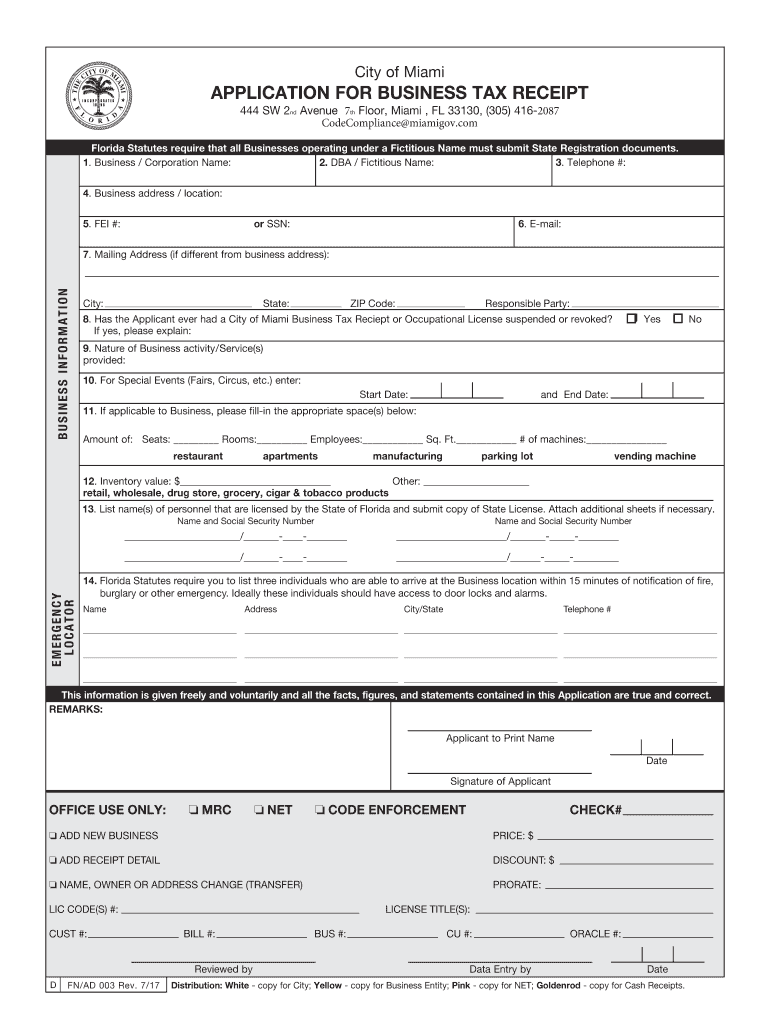

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

Business Tax Receipt How To Obtain One In 2022 The Blueprint

Forming Business In Broward What You Ll Need To Do Llc Or Fictitious Name Sunbiz Org Ein If You Ll Be Selling Ta Business Tax Broward Buying Wholesale

Affidavit To Transfer Broward County Local Business Tax Receipt

Business Tax Search Taxsys Broward County Records Taxes Treasury Div

Forming Business In Broward What You Ll Need To Do Llc Or Fictitious Name Sunbiz Org Ein If You Ll Be Selling Ta Business Tax Broward Buying Wholesale

Free 5 Sample Business Tax Receipts In Ms Word Pdf

Fl Local Business Tax Receipt Application Form Miami Dade County 2017 2022 Fill Out Tax Template Online Us Legal Forms

Business Tax Receipt How To Obtain One In 2022 The Blueprint

Affidavit To Transfer Broward County Local Business Tax Receipt