capital gains tax indonesia

As you can see above Indonesia uses a progressive tax rate. Sale of land andor buildings located in Indonesia.

Why Indonesia Should Raise The Income Tax Of The Ultra Rich Individuals

Or - are present in Indonesia during a tax year and intending to reside in Indonesia.

. The withholding tax rate on the transactions include. Sellers pay capital gains tax at the rate of 5 on gains made on the disposal of assets other than land or buildings. Under a trade and asset sale the gain on sale proceeds including any capital gain is taxed as part of normal income at the corporate income tax rate of 22 percent a 20 percent tax rate shall apply from year 2022 onwards.

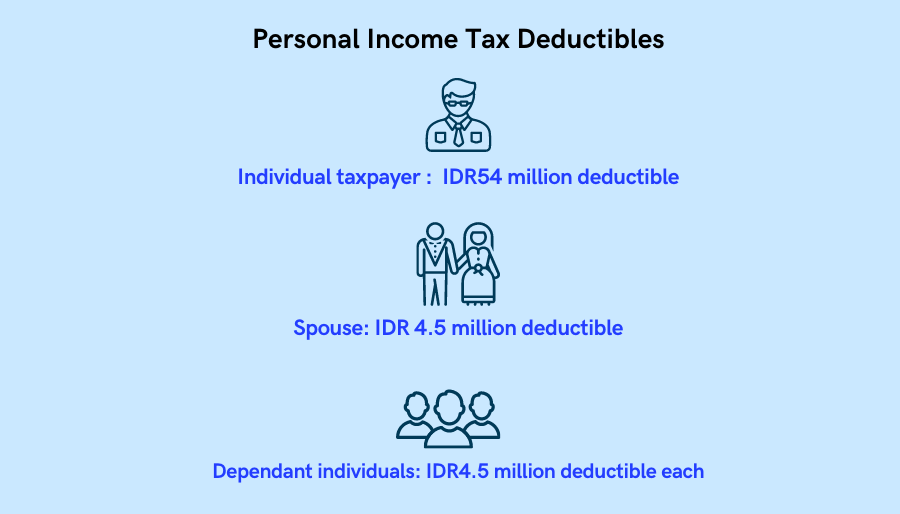

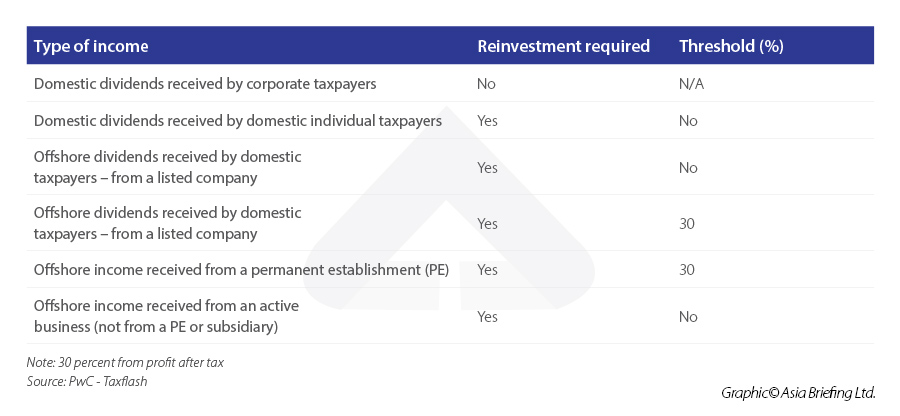

A tax resident is generally taxed on worldwide income although this may be mitigated by the application of double taxation agreements DTAs. Based on worldwide income taxation concept overseas investment income and capital gains are treated as normal income subject to income tax. In Indonesia if a resident taxpayer has a capital gain which is derived from income subject to final tax eg sale of shares listed on Indonesia Stock Exchange IDX sale of landbuilding dividend then it shall not be taxable on the AIITR but shall be declared on the AIITR attachment - III under the final tax income section.

Residency tests are applied as follows. Capital gains tax rate 22 standard ratevarious Residence. If youre a tax.

Or - stay in Indonesia for more than 183 days in any 12-month period. Purchasing of oil fuel by parties other than state-owned. The legality of crypto in the nation.

The VAT rate on crypto assets is well below the 11 levied on most Indonesian goods and services while the income tax on capital gains at 01 of gross transaction value matches that on shares. Taxation on Capital Gains and Investment Income Capital gains are generally assessable at standard income tax rates together with other income of the individual. It is also the worlds third-largest democracy and the worlds largest archipelagic state.

Individual resident taxpayers are individuals who. However the new Omnibus Law has added a provision to the Income Tax Law stipulating that foreigners who have become domestic tax. If the seller is non-Indonesian tax resident the 5 capital gain tax final due on gross basis will.

Sedangkan capital gain jangka panjang dalam barang koleksi dikenai pajak pada flat sebesar 28. The tax is 5 final tax or 25 from 8 September 2016 on the taxable. However sale of locally listed shares are subject to a final tax at 01 percent of gross sales proceeds and sale of domestic real estate is subject to 25 percent final income tax on the sale price.

Indonesia continues its serious efforts to promote foreign investment as well as domestic investment capital accumulation and. Di tahun 2015 capital gain jangka panjang dikenakan pajak yang bermacam-macam mulai dari 0 untuk pajak penghasilan 10 dan 15 15 untuk pajak penghasilan 25 sampai 35 atau 20 untuk 396 pajak penghasilan. On the transfer of assets other than land and buildings 25 capital gain tax due on net basis will apply for the Indonesian tax resident seller.

Individual - Taxes on personal income. Purchasing of oil fuel by state-owned gas stations or private gas stations. 025 or 030 based on the selling price.

Lease tax or rental income tax is also applicable for both tax residents and non-tax residents in Indonesia. Capital gains are assessable whilst a capital loss is tax-deductible only if the asset concerned is used in the running of the business. For non-tax residents the lease tax is 20 of the property lease.

Generally the VAT rate is 10 percent in Indonesia. Capital gains taxes. The settlement and reporting of the tax due is done on self-assessed basis.

5 rows 10. Value Added Tax VAT. A company is regarded as Indonesian tax resident if it is established or domiciled in Indonesia or if its place of effective management or control is in Indonesia.

Investasi tidak selalu untung terkadang Anda juga bisa merugi. In arriving at effective capital gains tax rates the. Last reviewed - 30 December 2021.

- are domiciled in Indonesia. 5 rows 30. Selain Capital Gain Anda Juga Bisa Mengalami Capital Loss.

Indonesia will impose a VAT rate of less than 11 levied on most Indonesian goods and services while the income tax on capital gains will be 01 of the gross transaction value. Capital gains are generally assessable together with ordinary income and subject to tax at the standard CIT rate. For tax residents the amount of lease tax is 10 of the property lease value.

Indonesia which consists of 17508 islands and approximately 270 million people is the worlds fourth-most-populous country. However gains from the transfer of land and buildings are not subject to regular CIT but rather are subject to final income tax at a rate of 25 of the transaction value or the government-determined value whichever is higher. Selain itu capital gain jangka panjang dikenakan pajak yang bermacam-macam mulai dari 0 10 15 25 35 hingga 396 pajak penghasilan PPh.

Speak with a tax professional to understand more about these additional taxes. For foreign companies without a PE in Indonesia the tax withheld from their Indonesia-sourced income by the Indonesian party paying the income Article 26 income. However the exact rate may be increased.

Taxation in Indonesia is determined on the basis of residency.

Capital Gains Tax Would Buffett Prefer To Live In Holland

Double Tax Agreements In Indonesia

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains And Why They Matter A Tax Expert Explains

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

Taxation Changes In Indonesia Under Tax Regulation Harmonization Law

Indonesia To Impose Vat Income Tax On Crypto Assets From May Reuters

Why Indonesia Should Raise The Income Tax Of The Ultra Rich Individuals

Top 8 Things To Know About Taxes For Expats In Indonesia

Mengenal 5 Jenis Pajak Di Indonesia Beserta Contohnya Income Tax Filing Taxes Capital Gains Tax

Indonesia To Impose Vat Income Tax On Crypto Assets From May Reuters

Universal Health Coverage In Indonesia Concept Progress And Challenges The Lancet

An Expat S Guide To The Indonesian Tax System

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law